Treasurers use your UB resources on Memberzone. If you can’t find it, or have a question; come to us directly.

Thanks, Your UB Champions – Nancy, Sandy and Darlene (email [email protected] )

1) Why are the expense amounts that I see on the Balance Report (Statement of Revenue and Expenses) different than the amounts on the receipts that were entered?

The expense amounts that you see on the Balance Report have been reduced by the amount of the GST Tax Rebate (50% for most expenses and 100% for expenses related to taxable activities). These tax rebates have been applied to each transaction at the time it is verified by the Unified Banking staff. If you want to check the amounts, the GST rebates are shown for each transaction on the Transaction Report for Expenses in Column M.

2) How do we change Treasurers, either mid-year and at the end of the Guiding Year?

- use the Authorization Form for both of these actions

- present Treasurer cancels her position; and the new Treasurer applies as the new Treasurer

- same form for P-Cards – reminder – August 28th, P-Cards are closed, until the new user is identified (again, year-end is August 31).

- and as a reminder; the former treasurer should not cancel until the new person is ready to take over. I’ve had a couple of situations where the former canceled, then left the Unit without anyone able to access the account to keep things up to date.

3) How long do we keep receipts?

- when Units complete the Year-End reconciliation for Unified Banking; UB Staff will verify that all paperwork has been downloaded, all receipts attached, expenses and revenue have been allocated, cookies accounted for, etc. Once you receive notification that your account and year-end report is verified, you can then shred all receipts. No need to keep receipts for 7 years.

UB Champions will be looking into this further, so we can assist you in being prepared for the year-end reconciliation.

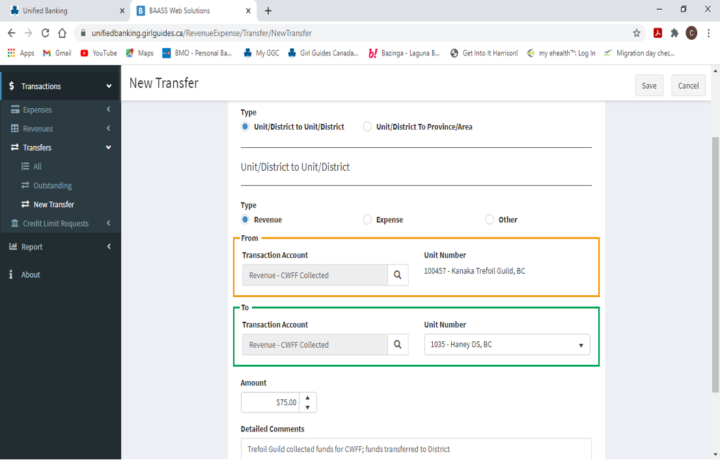

4) How should Units forward CWFF?

as Unified Banking Champions, we recommend Units transfer CWFF funds collected to their District. This will ensure District Treasurers are able to keep track of who has collected and who has not. The District Treasurer can then transfer funds directly to Province.

Process:

- Select “Transactions”;

- Select “Transfer”;

- Select “New Transfer”;

- Select “Unit/District to Unit/District”; from your Unit select Revenue collected CWFF funds, to Revenue CWFF collected to your District; use the Comments Box to explain the transfer; Reminders for CWFF – Revenue collected from parents – allocate as Dues for online payments; revenue – “CWFF collected” completed by Unit Treasurer

For District Treasurers – To Transfer to Province – The District Treasurer can transfer using Unit/District to Province/Area by following the same process. When you select this, you will notice the “To” section of the transfer disappears, that’s because Provinces and Areas aren’t on the UB system. Also, the choice of Revenue, Expense, or Other disappears as well.

- Select “Transactions”;

- Select “Transfer”;

- Select “New Transfer”;

- Select Expense – CWFF – Transfer to Province”.

- Insert the amount to be transferred. Again, add in comments you want to include, and it’s suggested to include the Province/AreaGL code if you know it, but it’s not necessary.

- Save, and done.

5) How should I allocate the Collecting of Facility Fees from Parents?

- with online payments – use DUES, and use the comment box to add some sort of notes in the comment section to indicate that this is facility fees and family name

- Facility fees – Transfer to District – When the Unit Treasurer transfers to the District they will select “Revenue” as the type and use the same category – Dues for both the Unit and District sides of the transaction. This will take the revenue out of the Unit and move it to be reported as revenue for the District.** note – UB is supposed to be modifying an account so that we can track facility fees but it hasn’t been done yet and it’s been suggested to me that it will likely not happen until the next Guiding year.

- Reminders for Facility Fees – Revenue collected from parents – allocate as Dues for online payments; as revenue – use the comment box to advise revenue collected is “Facility Fees”.

- Why are the expense amounts that I see on the Balance Report (Statement of Revenue and Expenses) different than the amounts on the receipts that were entered?

- How do we change Treasurers, either mid-year and at the end of the Guiding Year?

- How long do we keep receipts?

- How should Units forward CWFF?

- How should I allocate the Collecting of Facility Fees from Parents?

- Sometimes the amount showing as tax on the Expenses input screen is different than what I see on the receipt for p-card transactions. Why does this happen and should it be fixed?

- How do I transfer to Area or Province when asked to pay for things such as CWFF, Camp Kanaka booking, Cookies, PR material, etc.?

- When revenue deposits are received for taxable activities, such as overnight camps, is there anything special that needs to be done in the Unified Banking transaction to show the tax portion? How is the use of subsidies and campership recorded for activities?

- What needs to happen when a Guider who holds the Unit Purchase card returns to the same Unit for the next year?

- How do I record the fees collected from parents in the Unit for events that are organized by Area or Province?

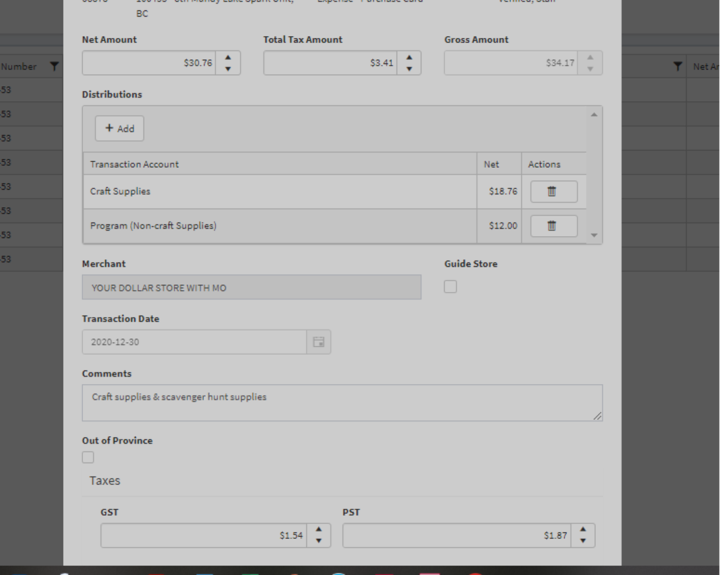

6) Sometimes the amount showing as tax on the Expenses input screen is different than what I see on the receipt for p-card transactions. Why does this happen and should it be fixed?

Sometimes, especially when purchases are made that include food items or from stores that sell food items, the taxes that are automatically calculated by the system when the p-card transactions are transferred into the system will not be accurate as the system “guesses” at the amount that would be tax. It is important to fix these tax differences so that the rebate is correctly applied and your expenses are reported accurately. To fix these items, alter the amounts for each of GST and PST in the bottom part of the input screen so they are the same as the tax amounts on the expense receipt. You may also need to correct the Net Amount at the top once the tax amounts have been corrected. In the example, the bottom section originally reported a tax as only $1.62 GST, so the $1.54 GST and $1.87 PST had to be entered into the bottom section to equal the $3.41 total tax from the receipt, and the top section altered to that amount as well, and the net amount needed to be changed to $30.76 to equal the $34.17 gross amount minus the $3.41 total tax.

Sometimes, especially when purchases are made that include food items or from stores that sell food items, the taxes that are automatically calculated by the system when the p-card transactions are transferred into the system will not be accurate as the system “guesses” at the amount that would be tax. It is important to fix these tax differences so that the rebate is correctly applied and your expenses are reported accurately. To fix these items, alter the amounts for each of GST and PST in the bottom part of the input screen so they are the same as the tax amounts on the expense receipt. You may also need to correct the Net Amount at the top once the tax amounts have been corrected. In the example, the bottom section originally reported a tax as only $1.62 GST, so the $1.54 GST and $1.87 PST had to be entered into the bottom section to equal the $3.41 total tax from the receipt, and the top section altered to that amount as well, and the net amount needed to be changed to $30.76 to equal the $34.17 gross amount minus the $3.41 total tax.

It is also important to check your manual expenses comparing the tax breakdown on the receipt agrees with the breakdown between the GST and PST at the bottom of the screen.

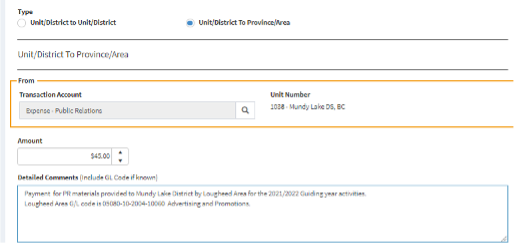

7) How do I transfer to Area or Province when asked to pay for things such as CWFF, Camp Kanaka booking, Cookies, PR material, etc.?

To make payments to Area in the Unified Banking system the Treasurer will select the Transaction category “Transfer”, then “New Transfer”, then under the first section “TX Type” select “Unit/District to Province/Area”.

You will notice that some of the screens below will be removed, simplifying what needs to be entered. This is because both Area and Province are on a different recordkeeping system and you will only be required to enter the Unit/District portion of the entry and provide comments to assist the National finance staff completing the entry.

To complete this transfer transaction, you must now select the appropriate account from the drop-down menu in the “From” section. Be careful that you select the Expense if you are paying for something, or Revenue if it is a revenue to your Unit/District (this will be unlikely). Then it is important that you add comment details explaining your transaction and give the G/L code if you have it.

Here are a few of the most often used G/L codes to help you out:

- CWFF to Province – 02410-10-10167 – DUE TO NATIONAL – Canadian World Friendship Fund (CWFF)

- PR Materials to Area – 05080-10-2004-10060 – Advertising and Promotion

- Camp Kanaka Fees to Area – 04300-10-2004-10542 – Camp Revenue

- Crests from Camp Kanaka to Area – 04402-10-2004-10542 – Merchandise Sales Crests

- Camping Equipment Rental to Area – 04335-10-2004 – Miscellaneous Revenue

- Fall Cookies to Area – 04101-10-2004 – Cookie Revenue Fall *

- Spring Cookies to Area – 04100-10-2004 – Cookie Revenue Spring *

* Note: Cookie payments will not often be required as transfers are usually taken directly by National.

If you have other types of payments that need to be completed, ask the Area Treasurer for the G/L code information or provide a clear, detailed description of what you are paying for.

Using an example of paying an Area invoice for $45 of promotional materials, this is what your entry will look like in your Unified Banking system:

8) When revenue deposits are received for taxable activities, such as overnight camps, is there anything special that needs to be done in the Unified Banking transaction to show the tax portion? How is the use of subsidies and campership recorded for activities?

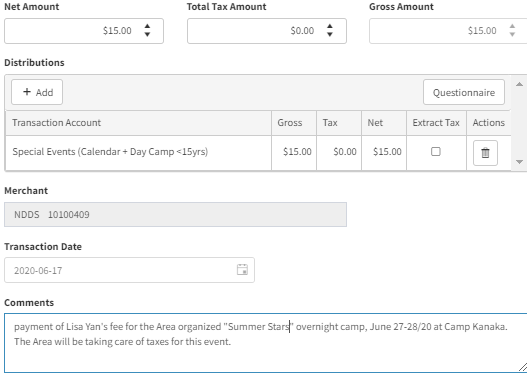

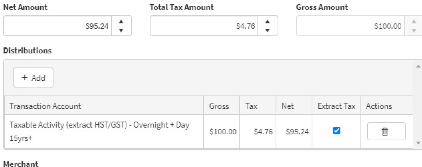

The revenue deposit will appear in the Unified Banking account within a couple of days of completing the deposit or e-transfer. The Unit’s Treasurer will need to allocate the revenue to the appropriate revenue account and check the box to “Extract Tax”.

If the Camp is not subsidized (i.e. cookie sales) or subsidized equally to all girls in the Unit the entry is quite simple. In the Distribution section select the “Taxable Activity (extract HST/GST) – Overnight + Day 15yrs+” revenue category then click the “Extract Tax” box to the right side of the row.

If the Camp is individually subsidized (i.e. per girl cookie sales) the entry takes an extra step to complete. There will be a second line in the Distribution section as well as the steps taken in the example above. Select the “Taxable Activity (extract HST/GST) – Overnight + Day 15yrs+” revenue category, enter the full (unsubsidized) cost of the camp, then click on the “Extract Tax” box as above, then on a second distribution row select the “Taxable Activity (extract HST/GST) – Overnight + Day 15yrs+” revenue category again, but this time do not click the “Extract Tax” box.

9) What needs to happen when a Guider who holds the Unit Purchase card returns to the same Unit for the next year?

When a Guider is staying with the same Unit, and continuing to hold that Unit’s Purchase Card, from one year to the next that card will remain active for the coming year. To make sure this happens the Guider should be aware of steps they may need to take:

Toward the end of a Guiding year the Guider will be sent a renewal by email which they will be required to reply:

- If they confirm that they are continuing in their position, then all of the positions would be extended, and the Purchase card date extended for one further year with no need to issue a new card, the current card can be continued to be used.

- If they give details about switching Units then that information would be input into iMIS. Since Purchase cards are Unit specific, the cards would been cancelled as the end of that Guiding year (i.e. 08/31/21).

- If they were ending their positions then the Purchase card end date would remain at the end of that Guiding year (i.e. 08/31/21).

- If the Guider does not reply, the procedure at the end of August would be to cancel the Guider’s positions, thus the card will be cancelled as well.

If a Purchase cardholder is unsure of the card’s (or their) status they can check their profile or the Unit roster to see if the Purchase card is tagged to them as a position. If the Guider does not see the “Purchase cardholder” position on their profile, and they will be continuing as the holder for that Unit they can contact [email protected] requesting that it be reinstated.

One more thing to remember, if there is no Treasurer for a Unit the Purchase card will be suspended until a Treasurer is training and identified.

10) How do I record the fees collected from parents in the Unit for events that are organized by Area or Province?

A Unit will sometimes collect the event fee for an activity organized by an Area or Province, then transfer those amounts up to Area/Province when requested (or the amount may be automatically withdrawn at a specified date by Area/Province). Note: this could be for an activity organized by the Area or Province where your Unit is situated or by any other Province or Area, including Camp Olave (which is has a separate account like an Area).

When recording the revenue deposits for these events or camps the allocation category that should be selected would be “Special Events (Area/Province + Day Camp <15yrs)” and the “Extract Tax” box should not be clicked. In the comments section provide details of the event name, dates, the level (Area/Province) that is organizing the activity, and note that the taxes will be handled by that level along with the name of the girl(s) who’s fees are included in the deposit.